On this day, 14 January 1960, the Reserve Bank Act 1959 comes into effect, fully separating the commercial and central banking arms of the Commonwealth Bank and renaming the latter the Reserve Bank of Australia. The central impulse behind the change is that central banking decisions were so crucial to the prosperity of the nation that they needed to be made by impartial experts and separated as much as possible from any political or commercial vested interests. The Reserve Bank Board, chaired by the Governor of the Reserve Bank, is given responsibility for conducting monetary and banking policy so as to best contribute to the stability of the currency, the maintenance of full employment, and the economic prosperity and welfare of the people of Australia.

The Commonwealth Bank had been established by the Fisher Government in 1911 as a government-owned savings and trading bank. Its initial intention was to act as the Government’s bank for loan raising and debt management, facilitate credit and guarantee savings for ordinary Australians, and keep the private banks honest by setting minimum standards against which they would have to compete. However, over time and in accordance with developments in economic theory the Commonwealth Bank gradually took on central banking functions, particularly as the bank was used to facilitate the payment of the costs of the First World War. In 1920, the bank was given responsibility for the issuing of banknotes, which had initially been conducted by the Treasury, giving it a powerful tool in controlling inflation.

In 1924 the Bruce-Page Government legislated to make the Commonwealth Bank Australia’s central bank, and created an independent bank board, made up of people from high up within the banking industry, to oversee its administration. During the Great Depression this board pushed for a conservative economic response to the crisis, leading Labor Treasurer Ted Theodore to draft proposals for the creation of a separate and more powerful central bank that might be more amenable to the proto-Keynesian approach that he advocated. These proposals were defeated in the Senate and under the Lyons Government Australia recovered from the depression using a policy of fiscal restraint which corresponded with the board’s viewpoint.

During the Second World War low unemployment and high spending power, combined with a reduced supply of consumer goods, to increase the risk of uncontrolled inflation. This risk was mitigated by the raising of war loans – one of the earliest and most direct interventions the Commonwealth Bank made in attempting to control inflation. The Commonwealth Bank also played a prominent role in wartime economic planning, and it formally took on further central banking responsibilities, such as exchange controls, interest rate controls, and the power to compel private banks to lodge funds with it in special accounts.

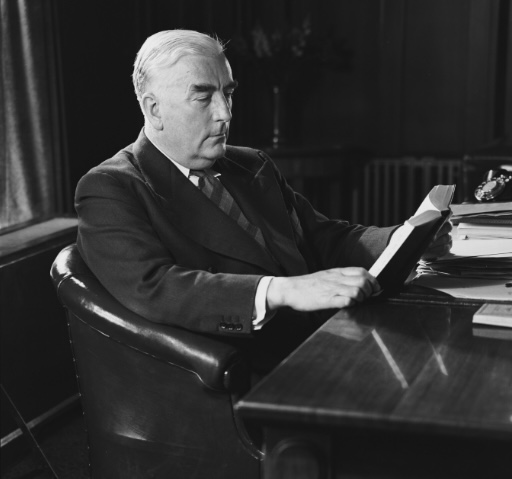

These additional central banking functions were made permanent by the Commonwealth Bank Act 1945 and the Banking Act 1945, giving the Commonwealth Bank clear powers over the administration of monetary policy, interest rates, banking policy, and exchange rate control. This legislation also notably increased the Government’s direct control of the bank by eliminating the independent board in a bitter recrimination for the administration of the Great Depression response – and one which Menzies, who otherwise supported strengthening the central banking powers, forcefully denounced claiming that ‘the adviser to any government or to any community should be detached, objective and utterly above the storm’.

While most of the 1945 reforms would survive, an attempt to force all public entities to bank exclusively with the Commonwealth Bank led to first a legal challenge by Melbourne City Council and then, in response to the challenge’s success, Chifley’s failed bank nationalisation attempt. The political furore which surrounded the nationalisation ensured that when Menzies came to power in late 1949, beyond rapidly moving to restore the board, he was keen to ensure the viability of the private banks which he believed were essential to freedom of choice, and to minimise the privileges associated with the Commonwealth Bank’s position as a government-backed commercial bank.

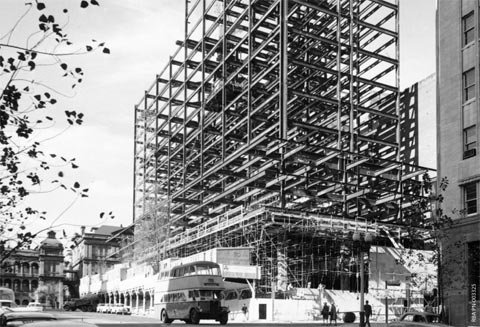

The Reserve Bank Act 1959 served this end by eliminating the contradiction of a Commonwealth Bank that acted as both a regulator and a competitor to the private banks, giving it an unfair advantage and also casting doubt over its ability to act with independent judgement. Menzies had taken the first step towards this with the legal separation of the Commonwealth Trading Bank in 1953, however both this and the central bank still operated under the same board until 1960. This existing board was transferred to the Reserve Bank, and a new Commonwealth Banking Corporation (consisting of the Commonwealth Trading Bank, the Commonwealth Savings Bank, and the Commonwealth Development Bank) was established. Ironically, Menzies was in many respects carrying through the proposals of ‘Red’ Ted Theodore – and this time Labor, who had a totemic attachment to a commercial Commonwealth Bank, voted against them.

These reforms would prove remarkably enduring. The Reserve Bank still operates under the same charter demanding the maintenance of currency stability, economic prosperity, and full employment (though the latter is now interpreted less rigidly). In 1983 the floating of the dollar meant the abolition of the Reserve Bank’s control over exchange rates, and in 1998 the Bank’s role as a supervisor regulatory agency was transferred to the Australian Prudential Regulation Authority (APRA), but otherwise its central banking functions remain largely the same today.

Further Reading:

‘Origins of the Reserve Bank of Australia’, Reserve Bank of Australia, https://www.rba.gov.au/education/resources/explainers/origins-of-the-reserve-bank-of-australia.html

Glenn Stevens, ‘Brief history of the Reserve Bank of Australia’, Address given to the Reserve Bank of Australia’s 50th Anniversary Gala Dinner, Sydney, 8 February 2010.

A.W. Martin, Robert Menzies, A Life Volume 2 1944-1978 (Melbourne University Press, 1999).

Sign up to our newsletter

Sign up for our monthly newsletter to hear the latest news and receive information about upcoming events.