| Entry type: Book | Call Number: 3046 | Barcode: 31290036150076 |

-

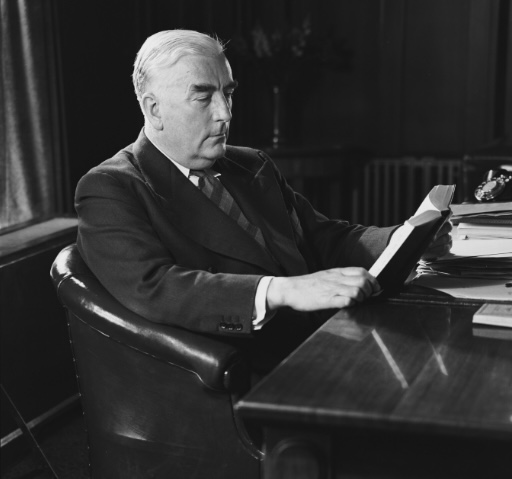

Author

Salter, Arthur

-

Publication Date

1933

-

Place of Publication

London

-

Book-plate

No

-

Summary

"Demand, therefore, except in countries near the margin of starvation, does not grow with prosperity beyond the growth of population.” Arthur Salter uses historical trends of international economic policy to develop a long-term plan for economic recovery and growth allowing a populace to live a life of sustainable prosperity in the aftermath of a war or depression. The task of rebuilding a nation post war befell Menzies upon his successful election in 1949. This book is heavily underlined which suggests Menzies employed Salter’s guidance during this period, and his policies prove this. Salter recommends the fostering of international trade, immigration and encouraging an active labour force, which were all key policies promoted by Menzies’s Liberal Government. The success of these policies surprised many who presumed the aftermath of war would be one of economic hardship, rather than the prosperity they experienced.

-

Edition

Reprint (first published April 1932)

-

Number of Pages

306

-

Publication Info

hardcover

Copy specific notes

Bookplate inserted; signed in pencil on front endpaper: “R. G. Menzies”. Some highlights of passages made in margin with pencil, including: “The tasks of the first post-war decade were to rebuilt the framework within which man could pursue his normal life of making, selling, consuming, to clear the channels of trade that had been blocked by the operations of war and to open others, and finally to restore a single and stable medium of exchange in place of the fluctuating and disorganised currencies with which war finance had littered the belligerent world. [/] And for a time it looked as if we had succeeded to an extent and with a rapidity beyond all reasonable expectation. The shortages of 1918 had disappeared by 1920.” [p. 3]; “Capital can only be forthcoming if sufficient people will save under the inducement of interest, and can only be well distributed under the guidance of differing interest rates if they will be in fact guided in their investments by this difference in rates.” [p. 19]; “The first thing that is overwhelmingly clear is that this is a world depression in the fullest sense. It is world-wide in the range of its effects; its causes, however originated, are clearly related to defects in the world system; and there is the strongest presumption that such remedial measures as may be possible will require the concerted action of many countries.” [p. 27]; “Demand shows no similar expansion. Mechanisation, both in industry and in agriculture, enormously increases the output per man. Industry can, within limits, increase its market correspondingly. There is no limit to what man will buy if he has the money; the pedestrian will advance to cycles, the cyclist to automobiles, and a taste for radios and gramophones and similar luxuries recently unknown can develop indefinitely. But man’s appetite is not similarly elastic. There are limits to the human stomach, as Adam Smith observed long ago. Demand, therefore, except in countries near the margin of starvation, does not grow with prosperity beyond the growth of population. More than that, the consumption per head of the big staple foods produced from the earth, like wheat, sometimes definitely goes down with increasing purchasing power, for more luxurious foods take their place. The per capita annual consumption of wheat flour in the U. S. A. fell steadily from 224 lbs. in 1889 to 175 in 1929.” [p. 32]; “The internal price of wheat in Germany and in France is more than twice the world price and, at a cost, has preserved to one privileged class an island of undiminished profits in a sea of depression.” [p. 32]; “Speculation has indeed a real economic function, as all the textbooks tell us […] Speculation based on economic realities may be beneficial, but ‘speculation on speculation’ is definitely injurious. And when this happens on a vast scale, the results may be widespread and disastrous.” [pp. 37 – 38]; “The unwillingness of the investor in American and France to lend abroad in the depression caused an inflow of gold from other countries. For, when a country is owed more than it owes, and does not re-lend the difference, gold has to be sent in payment. But as America and France did not need this extra gold it became in part ‘sterilised,’ that is, it was not as the basis of as much money as in the countries from which it had come. The net result of this ‘maldistribution’ of gold was therefore to reduce the total amount of money in the world, and thus to exert a depressing influence on the general level of prices […] Meantime while trade between different countries was prevented from finding its customary adjustments by all these impediments, the remaining method of restoring a balance, by the movement of men themselves, has been made impossible by the new restrictions in immigration.” [p. 39]; “The consequences of the visible cracking of the structure in Austria extended rapidly over a much wider area. The world’s balance of payments had for some years been maintained only by the constant renewal of large short-term advances which were liable to be called in at the first shock to confidence. Directly there was serious doubt as to the ability of one country to meet its obligations if its short-term advances were called in, people doubted whether other countries who had claims upon it, the counterpart of what they owed themselves, could avoid default. More than that, all the fears that had been slowly accumulating with the world depression, political uneasiness, and a growing realisation of the precarious nature of short-term advances as a basis of a world’s economic development, became accentuated.” [pp. 43 – 44]; “Meantime, however, the ‘standstill’ arrangement had reacted seriously on the British position. Great Britain herself had very large short-term obligations, against which the claims on Germany now ‘frozen’ were a substantial counterpart. She remained indeed a principal creditor country, with assets enormously in excess of her liabilities, but her assets were mainly in the form of long-term investments, and loans not quickly realisable; on short-term she owed more than she was owed now that her German advances were no longer liquid.” [p. 45]; “But that is not all. Great Britain, alarmed by the adverse balance of trade which underlay her financial weakness, thought she might reduce it by new tariffs, and also organised on a big scale a ‘Buy British Campaign’ which has much the same effect as tariffs except that it is purely ‘protective’ and brings in no customs revenue. A General Election in October resulted in the return of a Parliament with an overwhelming majority of supporters of the National Government, most of whom were in fact believers in protective tariffs for Great Britain though they had not been chosen on the issue. Already, however, before this happened the fall in the exchange value of the pound had had the protective effect of an import duty and the stimulating effects to exports of a bounty. This from the point of view of other countries was ‘exchange dumping and Canada and France promptly retorted by imposing additional duties against countries whose currency had depreciated.” [pp. 48 – 49]; “There is, that is to say, a gap in the balance of payments between debtor and creditor countries which is unabridged by new credit […] This is a process which may continue indefinitely to the advantage of all concerned, ono two conditions, first that the money borrowed is utilised for productive purposes which on the whole yield more net return each year than the service and dividends of the loans and investments; and secondly, that creditor countries which have on their international account lend that surplus to other countries and lend it in an appropriate form, which means, in effect, on a long-term basis so far as the needs for which it is required are long-term needs.” [pp. 51 – 52]; p. 60 on “gold” earmarked.

Sign up to our newsletter

Sign up for our monthly newsletter to hear the latest news and receive information about upcoming events.